Bond issue

Be part of Inbank's international growth story

The subordinated bond issue is completed

€6m

Volume. Can be increased to 12 million euros

if oversubscribed.

9%

Annual interest rate. Regular return

paid out quarterly.

10 years

Maturity. Premature redemption possible

after 5 years upon EFSA permission.

Our success factors

We’re born in Estonia, one of the world’s most digital economies and we're geared up to disrupt the European market.

Focused

Supported by a large ecosystem of partners. Since 2010 our sole mission has been to help our partners build the ultimate retail experience.

Entrepreneurial

The sky is the limit mindset, always open to new ideas. A track record of successful joint ventures and constantly looking for the next market to conquer.

Tech-driven

Fully embedded and flexible platform built on scalable proprietary tech and next-generation underwriting. A proven winning formula.

Viable

Banking license since 2015 with access to EU deposit markets, and bonds listed on Nasdaq Baltic Stock Exchange. With 12 years of profitable growth.

Key financials

In millions of euros

€182.4m

GMV

€15.6m

Total income

€2.9m

Net profit

| Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | |

|---|---|---|---|---|---|

| Loan and rental service portfolio | 765.9 | 815.9 | 856.3 | 937.4 | 975.1 |

| Impairment losses on loans | 1.7% | 1.3% | 1.6% | 1.7% | 1.5% |

| Return on equity | 57.7% | 8.4% | 7.3% | 10.2% | 10.6% |

Prospectus and conditions

Please acquaint yourself with the base prospectus and the final terms of the second series of bonds together with a summary and reporting for details.

View prospectusInbank subordinated bond issue

The purpose of raising capital is to strengthen our capital base and thereby contribute to Inbank’s international growth.

Issue volume

The volume of the Inbank subordinated bond issue is 6 million euros. In the case of oversubscription, the volume of the issue can be increased to 12 million euros.

Period

The maturity date of the bonds is 10 years with the issuer having a premature redemption right after 5 years. The Financial Supervision Authority must give its consent for the early redemption of the bonds.

Nominal value €1,000

Subordinated bonds are offered at a price of 1,000 euros per bond.

Annual interest 9%

We pay out interest once a quarter, thereby giving investors the opportunity to earn a regular return on their investment.

Listed on a stock exchange

Inbank's subordinated bonds are listed on the Nasdaq Tallinn Stock Exchange in the Baltic bond list. The bonds are freely tradable by the investor – they can be bought and sold on a regulated market.

Oversubscription

In the case of oversubscription, we may prefer clients, existing shareholders, bond investors and institutional investors.

Offer timeline

The subscription of the Inbank bonds starts at 10 am on 29 November and ends at 4 pm on 8 December. The bonds are issued on 13 December 2023, or a date near to that, and listed on the Nasdaq Tallinn Stock Exchange on or around 14 December 2023.

Investor seminar

Inbank Chairman of the Management Board Priit Põldoja and CFO Marko Varik presented the Inbank strategy and results on a webinar held in Estonian on 1 December at 2 pm.

Questions and answers

About us

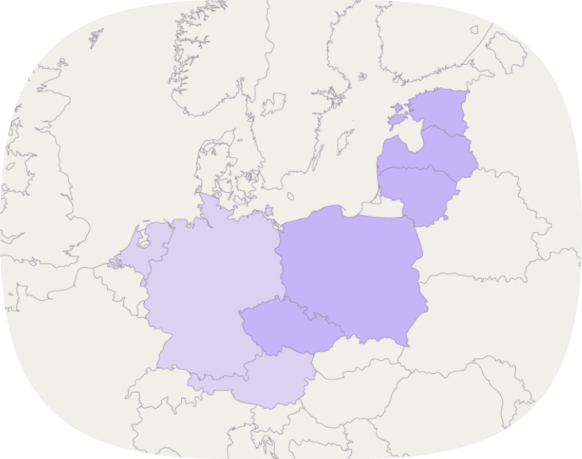

Inbank is a financial technology company with an EU banking license that connects merchants, consumers and financial institutions on its next generation embedded finance platform. Partnering with 5,800+ merchants, Inbank has 896,000+ active contracts and collects deposits across 8 European markets. Inbank employs more than 420 people from 17 nationalities. Our T2 bonds are listed on the Nasdaq Tallinn Stock Exchange.

896,000+

Contracts with happy shoppers

5,800+

Retailers with fully integrated seamless financing

8

Markets across Europe and quickly expanding

Make the smart investment

If you have any questions about the bond issue, please contact Priit Põldoja, the founder and Chairman of the Management Board of Inbank.

Contact us